Tokenomics

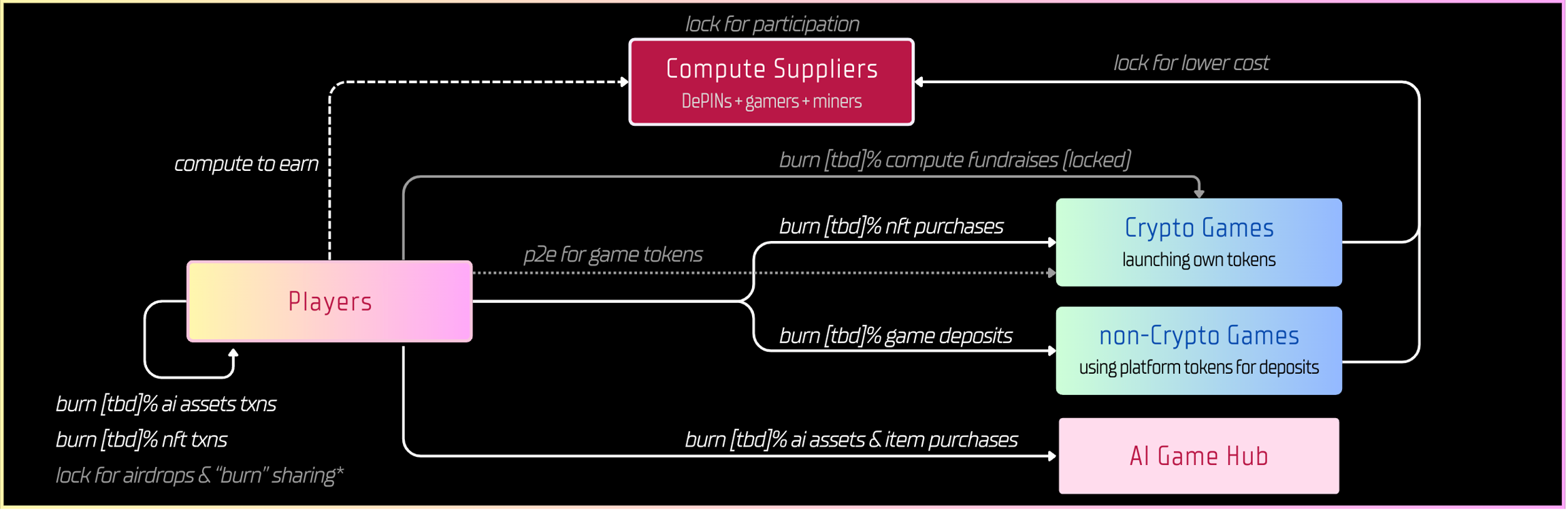

Burning Mechanism

Our token value capture lies on onboarding games, crypto or non-crypto, which facilitate game deposits, purchases and transactions of AI assets and NFT. The key burning mechanisms include:

Taxes on game deposits: Many of our platform games are expected to be non-crypto games, AI-enhanced from proven web2 success. The quality of these games should be high enough to generate continuous revenue streams.

Taxes on NFT sales and transactions: Our platform games are expected to launch NFTs to monetize, and players are expected to generate NFT assets for the AI agent social platform.

Locking Mechanism

Our goal is to lock as much circulating supply as possible in the market. The strategy to achieve this is to convey two concepts to our token holders:

Fundamental Value: Our token value is sustained by real game publishing revenue and NFT transaction fees. For marketing, a high focus will be placed on game pipeline development, renowned game producer and IP partnerships, and AI-native blockbusters.

Optimal Nash Equilibrium: The strategy is to create diversified lock programs for every stake holder, and to create a perception that there is limited counterparties who have incentives to dump the tokens. In particular,

Speculator: airdrops of future game NFTs and tokens are available only to locked tokens. The longer and more platform token a person locks, the larger portion of the airdrop pool he is entitled to. The design is for speculators to treat our platform tokens as a lottery ticket generator—you lock tokens for unlimited future gambles.

Value Investor: some % of the "burning" tokens are for profit sharing. The longer and more platform token a person locks, the larger portion of the profit sharing pool he is entitled to. The success of this locking strategy lies on how the community perceives our fundamental value.

VC Investor: We envision strong web2 on-ramping if our web2 marketing is done correctly. VC partners can lock tokens in an OTC vault for on-ramping purchases, so that VC partners can exit the position without slippages and earn rewards during the lock period.

Game Studio: The longer and more platform token a game studio locks, the more discount he receives for game computes.

Gamification: By locking the platform tokens, the holder is not entitled to all of the incentives mentioned in the previous bullet point. A holder needs to mix and match the strategies and varies the lock quantity and period to maximize his expected return.

Diversified Asset Classes: The most fundamental way to lock liquidity is to produce diversified asset classes. For that to happen, we envision to build:

AI Agent NFT Social Platform: Players can interact—chatting, decorating, and 1v1 battling by personality and backstories—with their and others' AI agents. We hope to facilitate players to buy, generate, and trade AI agents, AI assets, profile pictures, appearances, outfits, voiceprints, dialogue styles, and more.

Last updated